CORPORATE SECRETARY IN SINGAPORE:

ALL YOU NEED TO KNOW

INTRODUCTION TO BEING A CORPORATE SECRETARY IN SINGAPORE

Hello business owners, welcome to the world of entrepreneurship. After, the next important step that you need to undertake is appointing a Company Secretary. The regulation in Singapore stipulates that the appointment of a corporate secretary is mandatory for all companies in Singapore. There’s a list of requirements to be met before he/ she can be appointed as a Corporate Secretary in Singapore.

The main responsibility of a Corporate Secretary in Singapore is to take care of the administrative works and ensure compliance with Singapore’s rules and regulations. The Corporate Secretary’s role is also to assist the directors to submit all the necessary reports required for the company to establish its operation in Singapore. The Corporate Secretary is also responsible to inform the directors and shareholders about their legal obligations.

Considering the pile of administrative work to be done to comply with the Singapore government, most small to medium scale businesses prefer to outsource and engage Corporate Secretarial services from a third party to take care of their company’s paperwork.

A Corporate Secretary shall reside in Singapore. If a company has only one director, he/ she is not allowed to be a Corporate Secretary. If your company entity is Sole-Proprietorship or Limited Liability Partnership (LLP), then a corporate secretary is not needed.

Read this comprehensive guide before deciding whether you want to appoint a director to be the corporate secretary, employ a full-time corporate secretary, or outsource to a company like us, who provides Corporate Secretarial Services.

We’re just a Video Call Away

Whether you are starting your dream company or expanding your empire, Accounts Guru has your back!

We’ll take care of your Accounting, Tax & Corporate Secretarial work.

Book a free consultation with us.

DUTIES AND RESPONSIBILITIES

Duties to the company:

The Corporate Secretary’s duty is to check the latest statutory obligations and inform the directors and shareholders. A Corporate Secretary will also ensure compliance is up-to-date as required under the company law. The Corporate Secretary will also ensure ACRA’s Prescribed Anti-Money Laundering/ Combating the Financing of Terrorism (AML/ CFT) requirements are met every year.

Duties to the company directors:

A Corporate Secretary shall advise the directors and help them structure the various resolutions that need to be passed for the functioning of the company.

Duties to the company shareholders:

A Corporate Secretary shall advise the shareholders of the financial statement, announce all critical information regarding policy or regulation, and also maintain the company records by ensuring that all resolutions passed are signed in time and filed with ACRA.

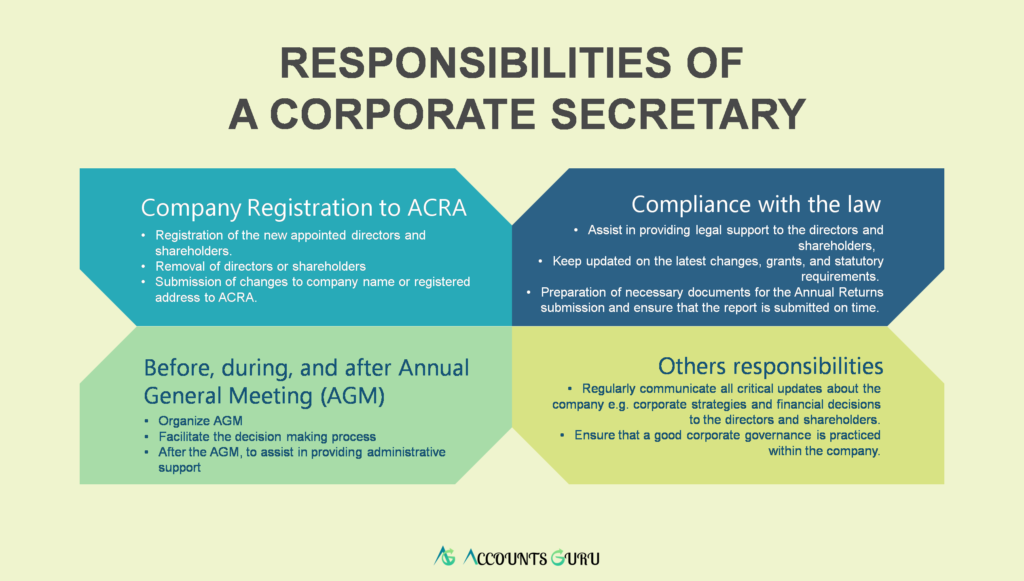

Responsibilities of a corporate secretary in Singapore

Company Secretaries’ responsibilities range from keeping the company profile updated on ACRA to disseminating minutes of meetings of the Annual General Meeting to all directors, shareholders, and relevant parties.

Below is the comprehensive list of what a corporate secretary is responsible for.

Company Registration on ACRA

- Registration of the new appointed directors and shareholders.

- Removal of directors or shareholders should they decide to leave the company.

- Submission of changes to company name or registered address to ACRA.

Before, during, and after Annual General Meeting (AGM)

- Organize Annual General Meeting (AGM), which requires the attendance of the directors and shareholders, in compliance with the Company Constitution and as required by the Company Act.

- Prior to the Annual General Meeting (AGM), the corporate secretary is to disseminate all critical information to all directors and shareholders, such as changes of company policy, updates of the regulatory requirement, and financial statements so that the directors and shareholders are prepared before the AGM.

- During the meeting, he/ she is to facilitate the decision making process.

- After the meeting, to assist in providing administrative support, e.g. sending the minutes of meeting to all relevant parties.

Compliance with regulatory requirements and law

- File and submit all necessary documents which are required by government regulation.

- Assist in providing legal support to the directors and shareholders, especially when it comes to compliance with the law.

- Keep updated on the latest changes, grants, and statutory requirements.

- Should there be overseas operations, to supervise the operation and establishment and ensure it complies with the local regulations and law.

- Preparation of necessary documents for the Annual Returns submission and ensure that the report is submitted on time.

Other administrative responsibilities:

- Regularly communicate all critical updates about the company e.g. corporate strategies and financial decisions to the directors and shareholders.

- Ensure compliance with all necessary regulations and all obligations are met, such as Company Constitution and MAA or known as Memorandum & Articles of Association.

- Ensure that a good corporate governance is practiced within the company.

- Supervise all matters which affect the shareholding, e.g. issuance of share certificate and timely transfers of dividends.

- Keep a record of the shares report and keep it updated.

- Ensure company identity, such as UEN and logo are being printed in the letter head, emails, and business letters.

- Should the company be going through acquisitions, mergers, or reconstruction, the corporate secretary shall ensure that the process is being carried out properly.

- Keep the company seal

WHO CAN BE A CORPORATE SECRETARY IN SINGAPORE?

It’s mandatory to appoint a corporate secretary as per company law. He/ she shall be a resident in Singapore (Singaporean, Permanent Resident, or EntrePass holder). If there’s only one director in the company he/ she is not allowed to be the corporate secretary. However, if your business entity is a Sole-proprietorship or Limited Liability Partnership (LLP), the requirement of having a corporate secretary in the company is not required.

According to the Companies Act section 171 (1AA), a corporate secretary shall at least have at least five years of experience as a corporate secretary. And he/ she shall not have a debarment order by the Registrar. A person who is a public registered public accountant can also be appointed as one.

THE IMPORTANCE OF CORPORATE SECRETARY

Entrepreneurship is a thrilling journey. Thinking of how to make more profits, gain more customers, and have a more efficient operating system can be exciting. Behind a successful business, there will always be good corporate governance. Here’s why having a professional corporate secretary is critical to your business:

Picking the right business entity

An experienced corporate secretary has in-depth knowledge and plenty of experience about the benefits of each. Depending on your business model, operation, and the number of directors/shareholders, a corporate secretary will be able to advise you about which business entity suits your business. Selecting the wrong business entity not only causes problems with and paperwork but also can cause you personal liabilities if the business entity you selected doesn’t have separate legal entities. This means when the business can’t pay the debts, owners’ personal assets are liable for a claim by the creditors. Selecting the right business entity will save you from a lot of problems that might occur in the future.

Saves Times

The biggest mistake a business owner can make is letting themselves get too absorbed by the less important work instead of working on the work that matters, keeping update with the latest statutory regulation, and other administrative works are time consuming. By engaging a Corporate Secretary, business owners can use their time for more important work like improving the marketing or strategizing on the business operations so they are more effective.

Risk mitigation

Save your company from unnecessary risk of not complying with the law or. Having a corporate secretary means having your company’s administrative work clean, tidy, and worry free.

Saves cost

We understand one of the concerns of hiring a full-time corporate secretary means an addition person to pay salary to. Fortunately, it’s not necessary to engage a full-time staff as a Corporate Secretary, you can outsource by Not only will you not need to pay a full salary, but also it saves you from all additional expenses and work, like advertising for the role or interviewing the candidate.